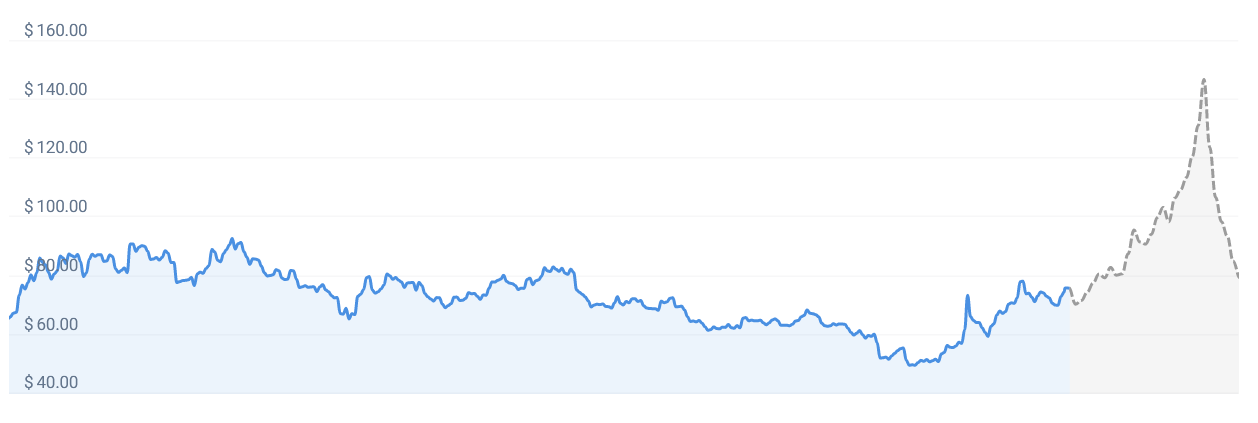

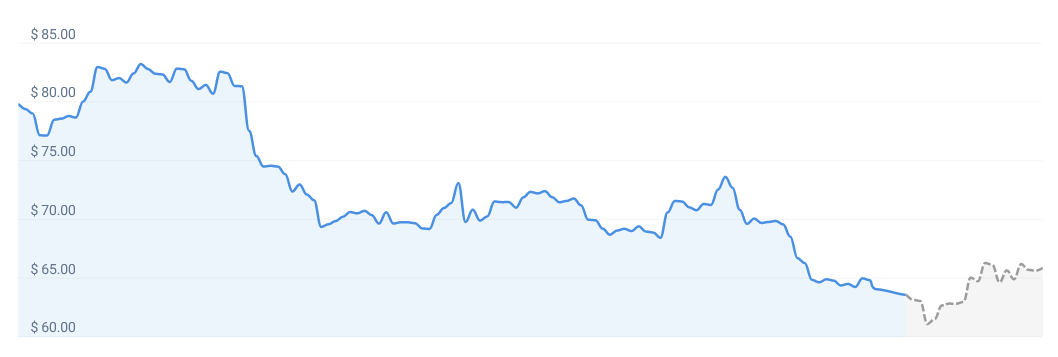

The decentralized finance (DeFi) sector has become a hotbed of financial innovation, and Aave, a leading DeFi protocol, stands tall among its peers. Our latest analysis presents an encouraging picture for this pioneering digital asset. According to our current Aave price prediction, the price of Aave is projected to rise by 2.25% and reach $ 77.74 by July 17, 2023.

This upbeat outlook is driven by a set of technical indicators that currently exhibit a “Bullish” sentiment towards Aave. This sentiment implies an expected uptrend in the price of the asset, suggesting that now could be an opportune moment for investors to consider purchasing Aave.

Further adding nuance to the understanding of the market sentiment is the Fear & Greed Index. This metric provides a snapshot of the emotional state of the market, using a variety of data points including volatility, market momentum, and social media activity. Despite the bullish sentiment, the Fear & Greed Index for Aave is showing a level of 57, which corresponds to “Greed”. This suggests a situation where investors might be driven by the desire for profit, potentially fuelling the price increase.

Reviewing Aave’s past performance, it recorded 19 out of 30 green days in the last month, making up 63% of the period. Green days are defined as those on which the closing price of the asset is higher than its opening price, indicating growth. This robust performance, interspersed throughout a month, underscores Aave’s ability to sustain intervals of growth even amidst the dynamic nature of the crypto market.

A noteworthy aspect of Aave’s market behaviour is its relatively high price volatility. Over the last 30 days, the asset experienced a volatility rate of 14.31%. In the cryptocurrency landscape, a higher rate of volatility implies larger price swings, presenting both a risk and opportunity. This volatility could result in sizeable returns for investors who can successfully navigate these price movements.

Based on our current forecast, this could be an excellent time to buy Aave. This recommendation is predicated on the overall bullish sentiment, the current Fear & Greed Index reading, and Aave’s consistent track record of green days. It’s crucial for potential investors to understand that while the outlook appears positive, the volatile nature of the cryptocurrency market always carries a certain level of risk.

In conclusion, our analysis indicates an anticipated rise in Aave’s price. Despite potential market fluctuations, the overall bullish sentiment, combined with the current Fear & Greed Index, suggests promising potential for this asset. As always, prospective investors are encouraged to carry out comprehensive research, stay informed about market trends, and seek expert advice when required. Navigating the dynamic world of cryptocurrencies requires a blend of insight, acumen, and patience, and it’s essential to approach each investment decision with a well-informed perspective.